Study Release: Options for Transporting Green Hydrogen from Türkiye to Germany

As Germany advances plans for a 9,000-kilometre hydrogen network, the question of where future imports will come from is increasingly relevant. A new study released by the Turkish-German Energy Partnership in an online event in November points to Türkiye as a potential supplier and discusses the respective advantages and challenges for both pipeline and seaborne transport.

Strengthening Bilateral Cooperation

In their opening remarks, Mustafa Çalışkan from the Turkish Ministry of Energy and Natural Resources (MENR) and Adrian Loets from Germany’s Federal Ministry for Economic Affairs and Energy emphasised the strength of long-running bilateral cooperation within the Turkish-German Energy Partnership’s Task Force Green Hydrogen. Türkiye is expanding its renewable energy portfolio and exploring export routes for green hydrogen, while Germany will rely heavily on imports even as domestic production increases. The two countries’ shared interest is clear: establishing dependable, large-scale supply chains for green hydrogen.

Pipelines vs Hydrogen Derivatives

According to the study, pipeline transport emerges as the most efficient way to deliver molecular hydrogen directly to Germany. Among the possible routes, the southern SoutH2 corridor appears the most economically compelling due to opportunities to retrofit existing gas infrastructure and operate at higher utilisation rates.

However, the analysis also makes clear that utilisation levels are decisive: a minimum throughput of around 50 TWh per year is required for a pipeline to be economically viable. Where volumes fall below this threshold—particularly in the early stages of market development—transporting hydrogen in the form of ammonia by ship becomes more favourable due to its lower levelized cost of transport (LCOT).

At the same time, the study notes that while shipping ammonia is cost-competitive, ammonia cracking significantly increases costs, which limits the attractiveness of this route for applications that require hydrogen in its original form.

Regulatory and Cross-Border Challenges

Beyond technical and cost considerations, the study underlines several structural challenges. Financing frameworks for cross-border hydrogen pipelines remain to be defined, and regulatory alignment between EU and non-EU jurisdictions will shape how quickly such corridors can progress. In the near term, hydrogen derivatives—including green ammonia—fit more readily into existing market rules, making them a more accessible export option for Türkiye.

The discussion also highlighted developments on the European side, particularly the phased introduction of the Carbon Border Adjustment Mechanism (CBAM) between 2023 and 2026. Covering products such as cement, steel, aluminium, fertilisers, electricity and hydrogen, CBAM will influence future trade conditions and the competitiveness of low-carbon supply chains.

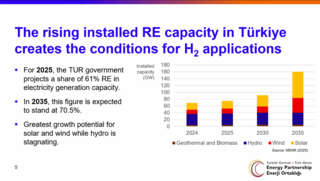

Türkiye’s Expanding Renewable Base

Türkiye’s renewable energy portfolio continues to grow, with government projections indicating that renewable sources will exceed 60% of installed capacity this year, rising to over 70% by 2035. Combined with its geographic position, this strengthens the country’s potential role as both a producer and a transit hub.

Outlook for European Integration

Integration with the European Hydrogen Backbone, as well as closer alignment with EU regulatory frameworks, may open the door to future cross-border infrastructure. In the meantime, hydrogen derivatives such as ammonia are likely to play a larger role, while both countries continue working on the conditions needed for pipeline corridors to become reality.

Active Engagement and Next Steps

The online seminar brought together 85 participants and featured an active discussion on practical considerations for future cooperation. The full study can be accessed here and a recording of the presentation is available further down in this article.